Bluerock Unveils Plans for Shareholder Liquidity Event in Real Estate Fund

July 3, 2025 - 20:39

Bluerock has revealed its intention to initiate a shareholder liquidity event for its prominent real estate investment vehicle, the Bluerock Total Income+ Real Estate Fund. This strategic move aims to provide an opportunity for shareholders to access liquidity, reflecting the company's commitment to enhancing shareholder value.

The proposed liquidity event is designed to facilitate a smoother exit for investors while allowing them to capitalize on their investment in the fund. As the real estate market continues to evolve, Bluerock is positioning itself to adapt to changing conditions and meet the needs of its shareholders.

The announcement has generated interest among current investors, who are keen to understand the potential implications for their investments. Bluerock's management is expected to provide further details on the mechanics of the liquidity event in the coming weeks, ensuring that shareholders are well-informed about their options.

This initiative signifies Bluerock's proactive approach to maintaining investor confidence and fostering a transparent investment environment.

MORE NEWS

February 21, 2026 - 23:16

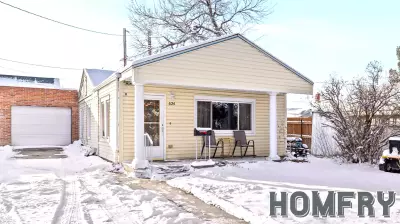

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...