Davis Real Estate Fund Sees Modest Returns in 2024

January 21, 2025 - 14:14

In 2024, the Davis Real Estate Fund reported a return of 4.89%, a noticeable decline when compared to the 9.15% return of the Wilshire U.S. Real Estate Securities Index. This performance has raised questions among investors regarding the fund's strategy and market positioning in an increasingly competitive real estate landscape.

Despite the underperformance relative to the index, the fund's management remains optimistic about long-term growth prospects. They attribute the modest returns to various market dynamics, including fluctuating interest rates and ongoing economic uncertainties that have affected the real estate sector as a whole.

The fund continues to focus on identifying high-quality properties and maintaining a diversified portfolio to mitigate risks. As the real estate market evolves, the management is committed to adapting their strategies to enhance returns and align with investor expectations. Stakeholders are encouraged to stay informed about upcoming adjustments and potential opportunities within the fund as it navigates the challenges ahead.

MORE NEWS

February 21, 2026 - 23:16

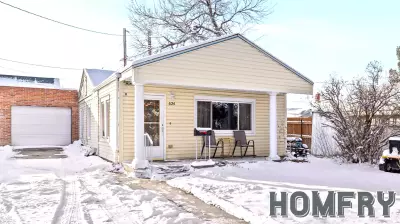

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...