Houston's Real Estate Challenges Amidst Oil Industry Fluctuations

June 30, 2025 - 16:10

President Donald Trump is advocating for a resurgence in American fossil fuel production with his rallying cry of “drill baby drill.” However, the effects of a downturn in the oil industry are already being felt in Houston, the nation's energy hub. The city, which has long thrived on the boom-and-bust cycles of oil prices, is now facing significant challenges in its real estate market.

As oil prices fluctuate, many companies are scaling back operations, leading to job losses and economic uncertainty. This has resulted in a surplus of commercial real estate, particularly in office spaces that once housed thriving energy firms. With fewer tenants and declining demand, landlords are struggling to fill vacancies, and rental prices are beginning to drop.

Home sales are also feeling the impact, as potential buyers become more cautious amid economic instability. The once-vibrant housing market is now experiencing stagnation, raising concerns about long-term implications for the city's growth. As Houston navigates these turbulent waters, the future of its real estate landscape remains uncertain.

MORE NEWS

February 21, 2026 - 23:16

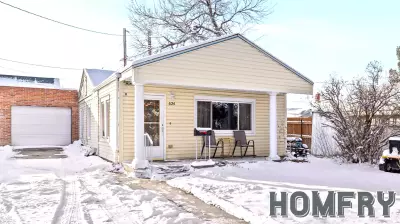

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...