Nashville Office Buildings Sold at a Significant Loss

January 7, 2025 - 13:14

In a notable transaction within the Nashville real estate market, Wheelock Street Capital has sold two prominent office buildings, Parkway Towers and Philips Plaza, for a total of $115 million less than their original purchase price. This sale highlights the shifting dynamics in the commercial property sector, particularly in urban areas that have experienced fluctuations in demand.

Originally acquired for a substantially higher price, the decision to sell these properties at a loss reflects broader trends affecting office spaces in metropolitan regions. Factors such as remote work, changing tenant needs, and economic uncertainties have contributed to a reevaluation of property values.

The sale of Parkway Towers and Philips Plaza underscores the challenges faced by commercial real estate investors in adapting to a post-pandemic landscape. As cities like Nashville continue to evolve, stakeholders are closely monitoring how these trends will influence future investments and property valuations. The outcome of this transaction may serve as a bellwether for the ongoing transformation of the office market.

MORE NEWS

February 21, 2026 - 23:16

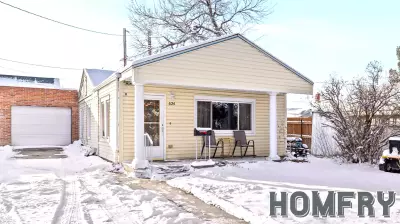

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...