Navigating Asian Real Estate: Japan and India Shine Amidst Uncertainties

April 14, 2025 - 12:43

In the current landscape of Asian real estate, Japan and India are emerging as attractive options for investors seeking stability and strong fundamentals. While China has long been viewed as a lucrative market, recent uncertainties and regulatory challenges have led many to reconsider their investment strategies in the region.

Japan offers a unique blend of economic resilience and a mature real estate market, making it a safe haven for those looking to invest. With a declining population, the focus has shifted towards revitalizing urban areas, presenting opportunities in both residential and commercial sectors.

On the other hand, India is witnessing rapid economic growth and urbanization, which are driving demand for housing and infrastructure. The government's initiatives to boost the real estate sector, coupled with a young and dynamic population, make it a promising destination for investment.

As investors weigh their options, the consensus appears to lean towards Japan and India as the preferred choices, while caution is advised when approaching the complexities of the Chinese market.

MORE NEWS

February 21, 2026 - 23:16

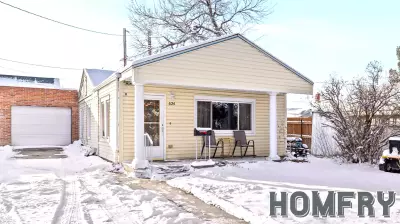

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...