Navigating the Future of Real Estate Investing in 2025

January 28, 2025 - 01:43

As we look ahead to 2025, the real estate sector stands at a critical juncture. Investors are closely monitoring the potential impact of the Federal Reserve's monetary policy, particularly regarding interest rates. While many had anticipated a more aggressive reduction in rates, current indicators suggest that the Fed may take a more cautious approach. This could have significant implications for real estate investment trusts (REITs) and the broader real estate market.

With interest rates potentially remaining higher for longer, the cost of borrowing could influence investment strategies. Investors may need to reassess their portfolios and consider the resilience of REITs, which often provide a stable income stream through dividends. The evolving landscape may also prompt a shift in focus towards sectors within real estate that demonstrate strong fundamentals, such as residential and industrial properties.

As the market adapts to these changes, understanding the dynamics of REITs and their role in a diversified investment strategy will be crucial for navigating the challenges and opportunities that lie ahead.

MORE NEWS

February 21, 2026 - 23:16

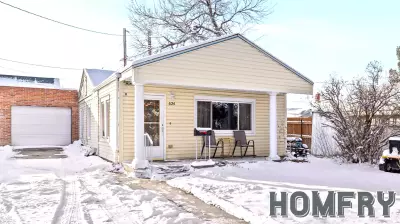

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...