Neuberger Berman Real Estate Securities Income Fund Declares Monthly Distribution

May 1, 2025 - 11:04

Neuberger Berman Real Estate Securities Income Fund Inc. has officially declared its regular monthly distribution, amounting to $0.0312 per share. This distribution is set to benefit shareholders and reflects the fund's ongoing commitment to delivering value to its investors.

The declared distribution will be payable to shareholders on a specified date, with the record date also announced. This monthly distribution is part of the fund's strategy to provide consistent income through investments in real estate securities. Investors can expect this distribution to be a key factor in their overall return on investment, especially in the current economic climate.

The fund has been proactive in managing its portfolio to ensure that it meets the income needs of its shareholders while navigating the complexities of the real estate market. As the fund moves forward, it remains focused on maximizing returns and maintaining transparency with its investors.

MORE NEWS

February 21, 2026 - 23:16

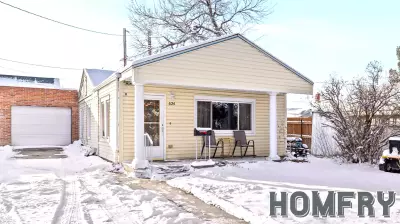

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...