Ohana's Strategic Acquisition: A Perfect Match for Growth

December 17, 2024 - 19:12

An executive from Ohana has revealed the strategic reasoning behind the company's recent acquisition of the 357-key Hyatt Regency located in a Seattle suburb. This move is seen as a significant step in aligning with Ohana's broader acquisition strategy, which focuses on expanding its portfolio in key markets.

The Hyatt Regency's prime location and robust performance metrics make it an ideal addition to Ohana's offerings. The executive emphasized that the property not only complements their existing assets but also enhances their ability to cater to a diverse range of guests, from business travelers to families seeking leisure experiences.

Furthermore, the acquisition reflects Ohana's commitment to investing in high-quality properties that promise long-term value. With this latest addition, the company aims to strengthen its presence in the competitive Seattle market, leveraging the Hyatt brand's reputation and operational expertise to drive future growth. This strategic move underscores Ohana's vision of creating a well-rounded portfolio that meets the evolving needs of today’s travelers.

MORE NEWS

February 21, 2026 - 23:16

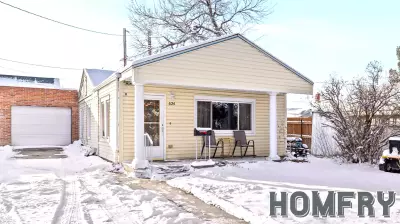

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...