Pershing Square Makes Bold Move to Acquire Howard Hughes for $85 Per Share

January 13, 2025 - 11:33

In a significant development in the real estate sector, Pershing Square, led by renowned investor Bill Ackman, has proposed a takeover of real estate developer Howard Hughes Corporation at an enticing price of $85 per share. This offer reflects Pershing Square's confidence in Howard Hughes' potential for growth and profitability.

The proposed acquisition comes at a time when Howard Hughes has been navigating various market challenges. Ackman's firm believes that acquiring the company will unlock substantial value and enhance operational efficiency. This strategic move indicates Pershing Square's commitment to expanding its portfolio in the real estate market, which has shown resilience despite economic fluctuations.

Investors and market analysts are closely monitoring the situation, as this acquisition could reshape the landscape of real estate development. The response from Howard Hughes' board and shareholders will be pivotal in determining the outcome of this ambitious proposal. As negotiations unfold, the implications for both companies and the broader market remain to be seen.

MORE NEWS

February 21, 2026 - 23:16

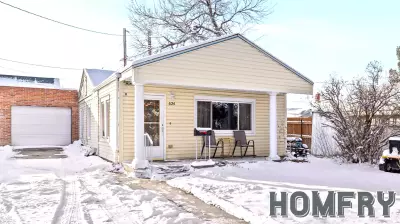

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...