Peter Schiff Challenges Michael Saylor's Bitcoin Real Estate Analogy

December 19, 2024 - 03:34

Financial market commentator Peter Schiff has taken issue with Michael Saylor's recent comparison of MicroStrategy's debt-driven Bitcoin acquisition strategy to investing in Manhattan real estate. In a post on social media, Schiff articulated his disagreement with Saylor's analogy, emphasizing the fundamental differences between the two asset classes.

Schiff pointed out that real estate has the advantage of generating rental income, which can be utilized to service and repay any associated debt. In contrast, he argued that Bitcoin does not produce any income, making it a riskier investment when leveraged. This lack of income generation raises concerns about the sustainability of Saylor's strategy, especially as interest and principal payments come due.

Schiff's critique highlights ongoing debates within the financial community regarding the viability of Bitcoin as a long-term investment and the risks associated with leveraging assets that do not provide cash flow. The discussion continues as investors weigh the merits and pitfalls of cryptocurrencies against traditional real estate investments.

MORE NEWS

February 21, 2026 - 23:16

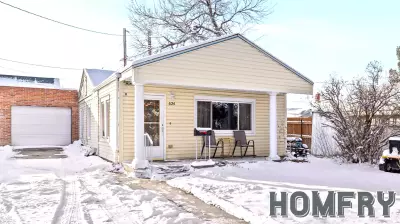

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...