Real Estate Experts Caution on Office Market Challenges Amid Rising Costs

November 14, 2025 - 10:50

Adam Winstanley, a prominent figure in Connecticut's real estate development scene, has expressed concerns over the current state of the office market. He emphasizes the significant financial challenges that investors face, stating that it has become increasingly difficult to turn a profit in office investments. With soaring costs impacting the industry, Winstanley urges stakeholders to exercise caution during this uncertain economic climate.

The office sector has been grappling with various challenges, including shifts in work patterns and the ongoing effects of the pandemic. As companies reassess their space needs, many are opting for flexible arrangements, leaving traditional office spaces underutilized. This trend has led to increased vacancies and declining rental rates, further complicating the landscape for investors.

Winstanley's insights reflect a growing sentiment among real estate leaders who advocate for a prudent approach to navigating the complexities of the current market. As the situation evolves, stakeholders are encouraged to remain vigilant and adaptable to changes in demand and economic conditions.

MORE NEWS

February 21, 2026 - 23:16

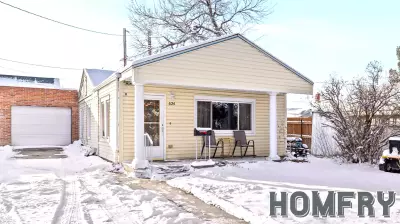

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...