Surge in Interest: Japanese Companies Attract Global Investment in Real Estate

November 28, 2024 - 11:30

Global hedge funds and private equity firms are increasingly focusing on Japanese companies as they seek to capitalize on an estimated ¥25 trillion ($165 billion) in undervalued real estate assets. This trend highlights a significant shift in investment strategies, with foreign investors recognizing the potential for substantial returns in Japan's real estate market.

The allure of Japan's property sector stems from its unique economic landscape, characterized by a combination of low interest rates and an aging population. These factors have contributed to a stagnation in property values, creating opportunities for savvy investors to acquire assets at bargain prices. As a result, numerous global firms are positioning themselves to take advantage of these market conditions, aiming to unlock hidden value within Japanese real estate.

Analysts predict that this influx of foreign capital could lead to a revitalization of the local market, driving up property values and fostering economic growth. As Japanese companies become increasingly attractive to international investors, the landscape of real estate investment in Japan is poised for transformation.

MORE NEWS

February 21, 2026 - 23:16

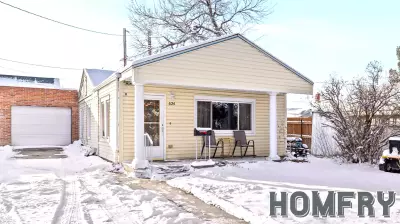

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...