Surge in Required Household Income for Homebuyers

May 4, 2025 - 13:30

The national household income needed to afford a house surged by nearly $47,000 since six years ago, highlighting the growing challenges faced by potential homebuyers. As housing prices continue to escalate, buyers now need to earn approximately 70% more than they did in 2017 to secure a home.

This dramatic increase is largely attributed to a combination of rising property values and limited housing supply. Many regions are experiencing a significant imbalance between demand and availability, driving prices even higher. The situation has become particularly daunting for first-time buyers who often struggle to save for down payments while navigating a competitive market.

Experts suggest that prospective homeowners may need to explore alternative options, such as considering homes in less expensive areas or seeking assistance programs designed to help with affordability. As the market evolves, the dream of homeownership is becoming increasingly elusive for many, prompting discussions about the need for policy changes to address these challenges.

MORE NEWS

February 21, 2026 - 23:16

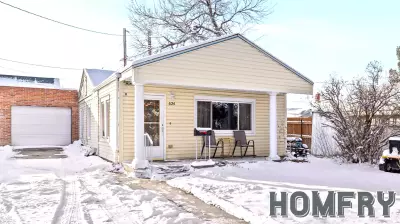

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...