Surge of Singaporean Investors in Japanese Real Estate Amid Yen Decline

October 29, 2025 - 04:20

In a significant shift in the real estate market, Singaporean investors have now become the leading buyers of Japanese properties, surpassing Hong Kong investors. This trend comes as the Japanese yen has reached a multi-year low, making investments in the country more attractive for foreign buyers. At one prominent investment firm, Singaporeans now account for a staggering 50% of all transactions in the Japanese real estate sector.

The depreciation of the yen has created a favorable environment for investors looking to capitalize on lower property prices. Singaporean investors are particularly drawn to the stability and potential growth of the Japanese market, seeking opportunities in both residential and commercial properties. This influx of investment is anticipated to bolster the Japanese real estate market, providing a much-needed boost amid economic uncertainties.

As Singaporeans continue to dominate this market segment, industry experts are closely watching the evolving dynamics and potential long-term implications for both Japan and Singapore's real estate landscapes.

MORE NEWS

February 21, 2026 - 23:16

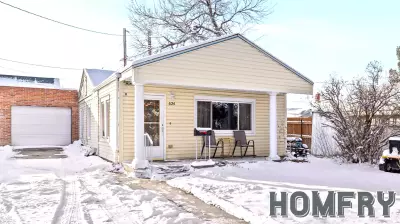

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...