Transforming Real Estate: Tokenization Projected to Hit $4 Trillion by 2035

April 25, 2025 - 09:00

A recent report forecasts that the tokenized real estate market could soar to an impressive $4 trillion by the year 2035. This transformation is driven by the movement of securitized loans, investment funds, and land ownership onto blockchain technology. The integration of blockchain into private real estate markets is expected to revolutionize how properties are bought, sold, and managed.

Tokenization allows for fractional ownership, enabling more investors to participate in real estate markets that were previously accessible only to wealthy individuals or large institutions. By digitizing assets, the process becomes more transparent, efficient, and secure, reducing the barriers to entry for many potential investors.

Furthermore, the adoption of blockchain technology in real estate transactions could streamline processes, lower transaction costs, and enhance liquidity. As the industry embraces these innovations, the potential for growth and increased participation in the real estate market is significant, paving the way for a new era of investment opportunities.

MORE NEWS

February 21, 2026 - 23:16

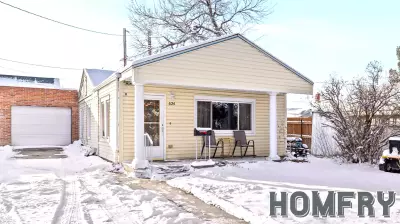

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...