Trez Capital Freezes Fund Redemptions Amid Increased Investor Withdrawals

August 19, 2025 - 02:22

Trez Capital has announced the suspension of redemptions across five of its real estate funds. This decision comes as the private real estate manager grapples with a surge in withdrawal requests from investors. The firm cited “elevated” withdrawal demands, ongoing loan funding requirements, and the necessity for debt workouts as key factors influencing this move.

The suspension is aimed at maintaining the financial stability of the funds while addressing the liquidity challenges posed by the current market conditions. Investors are being informed that the freeze on redemptions will remain in effect until the firm can adequately manage the situation and ensure the funds' overall health.

This action highlights the ongoing pressures in the real estate sector, where various factors, including rising interest rates and economic uncertainties, have led to increased volatility. Stakeholders are closely monitoring how Trez Capital navigates these challenges during this tumultuous period in the investment landscape.

MORE NEWS

February 21, 2026 - 23:16

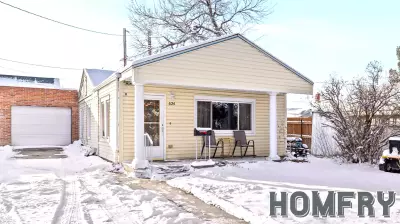

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...