YieldMax Introduces New ETF Focused on Real Estate Options

April 17, 2025 - 19:52

YieldMax has expanded its lineup of options strategy exchange-traded funds (ETFs) with the launch of the YieldMax Target 12 Real Estate Option Income ETF, known by its ticker symbol RNTY. This innovative financial product aims to provide investors with a unique opportunity to generate income through the real estate sector while utilizing options strategies.

The RNTY ETF is designed to capitalize on the potential of real estate investments, combining traditional property assets with sophisticated options trading techniques. By doing so, it seeks to enhance returns and provide investors with a diversified income stream. This new offering reflects YieldMax's commitment to meeting the evolving needs of investors who are looking for alternative ways to participate in the real estate market.

With the increasing interest in real estate as a viable investment option, the introduction of RNTY is timely. Investors will be keen to see how this ETF performs in the current market environment and whether it can deliver on its promise of income generation through strategic options trading.

MORE NEWS

February 21, 2026 - 23:16

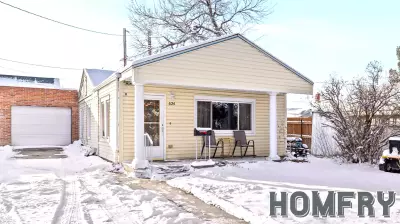

Rogue Agents – EXP Realty LLC Real Estate Guide for Feb. 22This Sunday, the Rogue Agents team of EXP Realty is opening the doors to five distinct properties, offering prospective buyers a prime opportunity to explore available homes in the area. The...

February 21, 2026 - 04:36

The highs and lows of Minnesota’s 2025 housing marketProspective homebuyers and sellers in Minnesota are facing a market of contrasts as they look toward 2025. The latest comprehensive analysis of statewide housing data reveals a landscape defined by...

February 20, 2026 - 03:19

Real Estate Transactions: Feb. 20, 2026The regional real estate landscape witnessed several significant transactions in the latter part of February, highlighting activity across different price points. In Athol, a commercial transfer...

February 19, 2026 - 05:42

Real estate secondaries volume reached a record $20bn in 2025The market for real estate secondaries has reached an unprecedented milestone, with transaction volumes soaring to a record $20 billion in 2025. This surge highlights a fundamental shift in the...